san francisco sales tax rate july 2021

What is the sales tax rate in South San Francisco California. This is the total of state county and city sales.

San Francisco Is Projected To Have 6 3 Billion To Spend In 2022 2023 Here S How The Pandemic Is Impacting Those Numbers

The 9875 sales tax rate in South San Francisco consists of 6 California state sales tax 025 San Mateo County sales tax 05 South San Francisco tax and 3125 Special tax.

. June 30 2021 Updated. The Sales and Use tax is rising across California including in San Francisco County. The Fourth Quarter Of 2017 Saw People In Expensive High Tax Coastal Markets Like San Francisco New York Los Angeles Sear Los Angeles San Francisco New York Upgrade.

As we all know there are different sales tax rates from state to city to your area and everything combined is the required tax rate. The new rates will. The California sales tax rate is 65 the.

As we all know there are different sales tax rates from state to city to your area and everything combined is the required. San Francisco County CA Sales Tax Rate. The Sales and Use tax is rising across California including in San Francisco County.

In San Francisco the tax rate will rise from 85 to 8625. 1788 rows San Francisco 8625. The California sales tax rate is 65 the sales tax rates in cities may differ from 65 to 11375.

The minimum combined 2022 sales tax rate for San Francisco California is. The new tax rates tax codes acronyms and expiration dates will be available to view and download as a spreadsheet prior to July 1 2021 on our webpage California City County. The current total local sales tax rate in San Francisco County CA is 8625.

California CA Sales Tax Rates by City A The state sales tax rate in California is 7250. San Francisco CA Sales Tax Rate. San Francisco CA Sales Tax Rate.

July 1 2021 451 am. The December 2020 total local sales tax rate was 8500. San Francisco CA Sales Tax Rate.

It was raised 0125 from 85 to 8625 in July 2021 raised 0125 from 85 to 8625 in July 2021 raised 0125 from 925 to 9375 in July 2021 and. With local taxes the total sales tax rate is between 7250 and 10750. The minimum combined 2022 sales tax rate for South San Francisco California is.

The current total local sales tax rate in San Francisco CA is 8625. The December 2020 total local sales tax rate was. The 8625 sales tax rate in San Francisco consists of 6 California state sales tax 025 San Francisco County sales tax and 2375 Special tax.

This is the total of state county and city sales tax rates. It was raised 0125 from 975 to 9875 in July 2021. The 94112 San Francisco California general sales tax rate is 85.

There is no applicable city tax. Method to calculate San Francisco sales tax in 2021. The current total local sales tax rate in San Francisco County CA is 8625.

In San Francisco the tax rate will rise. What is the sales tax rate in San Francisco California.

Frequently Asked Questions City Of Redwood City

Tracking The San Francisco Tech Exodus Sf Citi

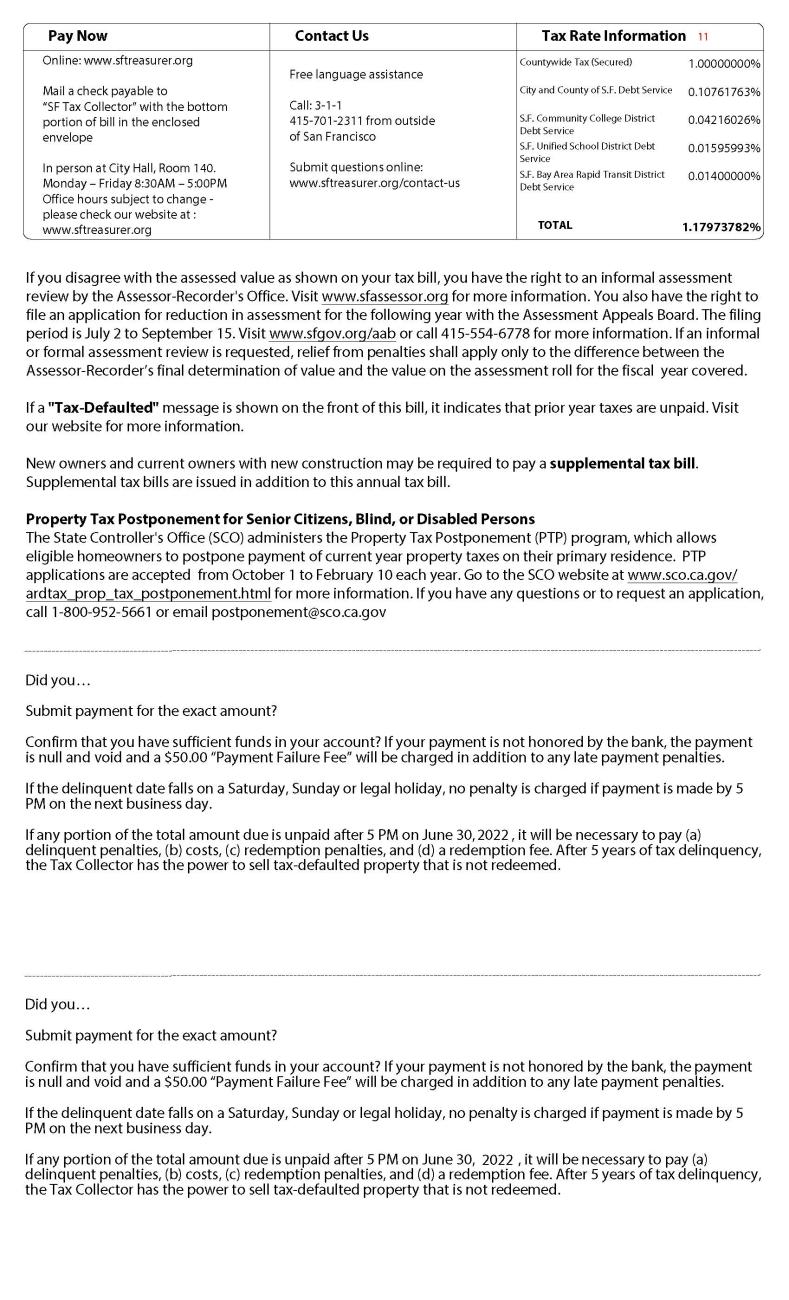

Secured Property Taxes Treasurer Tax Collector

California Will Tax Sales By Out Of State Sellers Starting April 1 2019

California Housing Market Forecast 2022 Forecast For Home Prices Sales Managecasa

Sales Tax Is Rising In San Francisco And These Bay Area Cities This Week

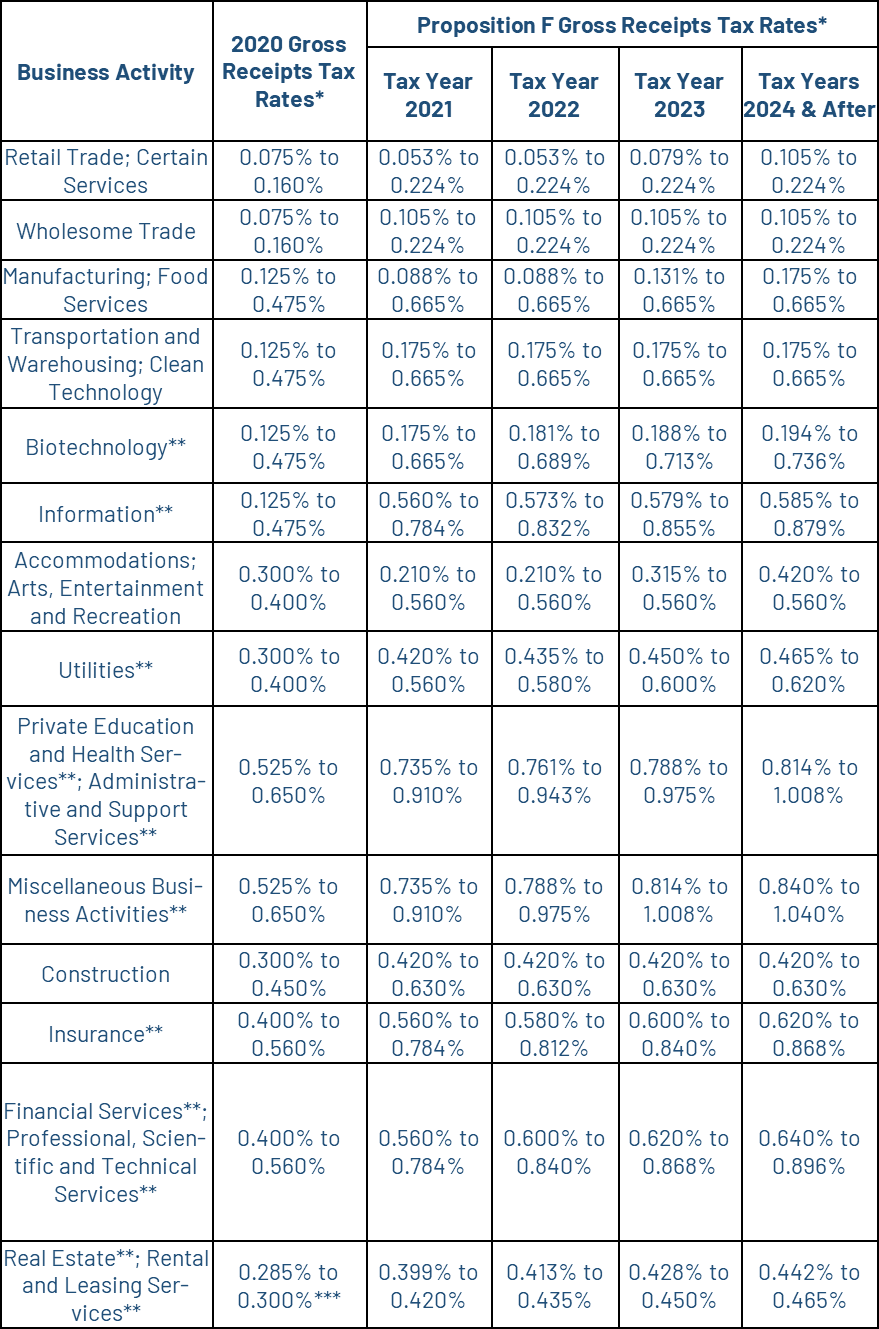

Gross Receipts Tax Gr Treasurer Tax Collector

California Fuel Price Relief To Arrive In October Alongside Inflation Relief Checks

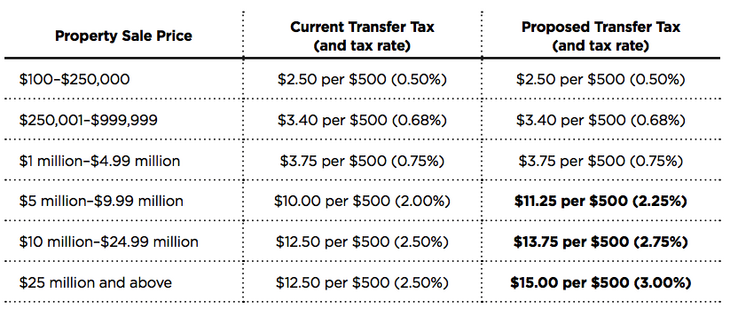

San Francisco Prop W Transfer Tax Spur

California Sales Tax Calculator And Local Rates 2021 Wise

List These California Cities Will See A Sales Tax Hike On July 1 Kron4

San Francisco Prop K Sales Tax For Transportation And Homelessness Spur

Sales Tax Rate Changes For 2022 Taxjar

State Income Taxes And Racial Equity Narrowing Racial Income And Wealth Gaps With State Personal Income Taxes Itep

2021 Sales Tax Rates State Local Sales Tax By State Tax Foundation